WHAT INFLUENCES THE PRICE OF STEEL?

2021 Steel price forecast is more complicated than you might assume. Steel is a global commodity and that means the price of steel varies on a daily basis. Prices can be influenced by several factors, including natural disasters, the strength of the American dollar, and the general condition of the world economy.

| DOMESTIC FACTORS | GLOBAL FACTORS |

| The strength of the United States dollar

Demand for steel used in any product Trade tariffs Exchange rate between local currency and dollar |

The general condition of the world economy

Natural disasters Wars and other political events |

WHAT HAPPENED WITH STEEL MARKET IN 2020?

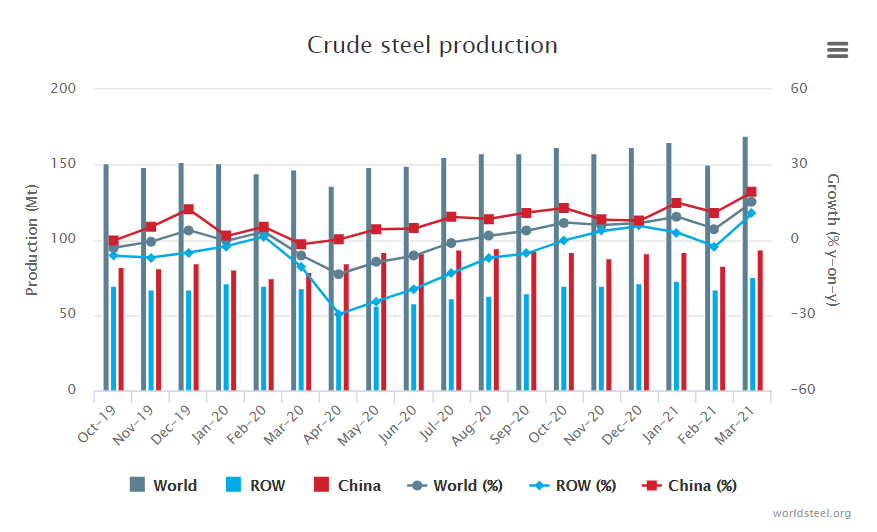

The COVID-19 pandemic had a massive effect on the entire world economy, including the steel industry. The combination of lockdowns, rising unemployment, and general uncertainty cratered demand for steel – bottoming out in February before rebounding in late May.

According to tradingeconomics.com, steel prices bottomed out in April 2020 before recovering in November and December 2020. Prices were expected to continue to increase due to a lack of supply and increasing demand as the United States and China’s economies rebound from the pandemic.

As governments gradually lifted lockdowns, pent-up demand initially boosted economic activity, but according to Al Remeithi, Chairman of the Worldsteel Economics Committee, it wasn’t enough to offset the damage of the pandemic to date. This is especially true in North America, where demand dropped 15.3% from 2019. Despite these factors, however, the steel industry has rebounded steadily with prices increasing into December 2020.

WHY STEEL PRICES ARE MEASURED IN YUAN?

Trading Economics presents the price of steel according to the Chinese currency called Yuan. This is primarily due to the fact that China is the world’s largest producer and typically the biggest consumer of steel. To convert the steel price from the graph, simply use this currency converter to see the exchange rate between Chinese Yuan and American Dollar.

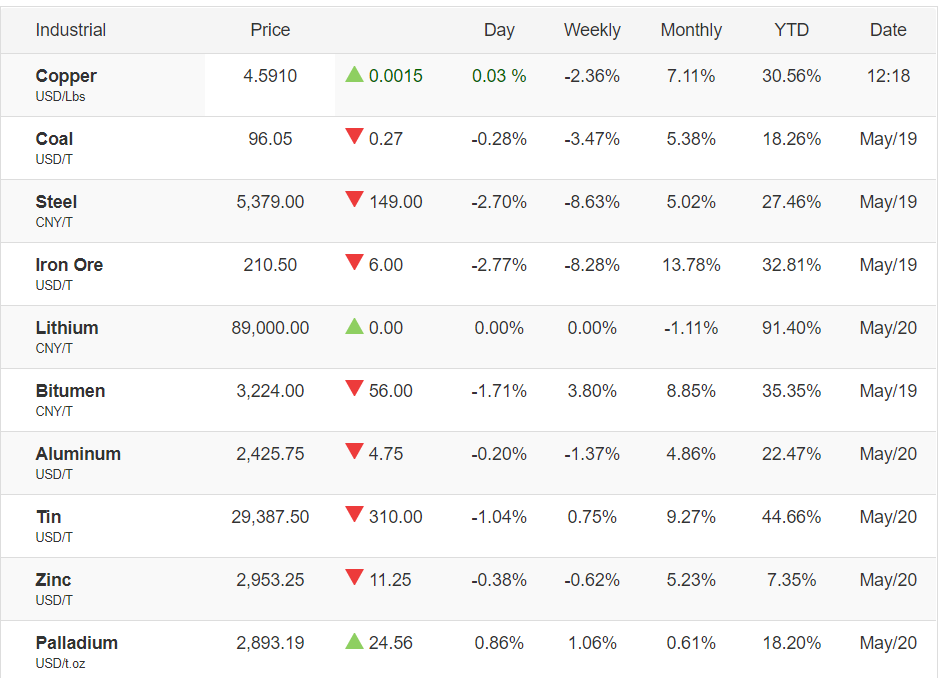

The Price chart on the world market on May 20, 2021

2021 STEEL PRICE FORECAST

It seems every year is more volatile than the last, and 2020 certainly continued that trend. A global pandemic, contentious U.S. presidential election, and the resulting unrest have made forecasting more difficult than ever. While these factors negatively impacted steel demand in 2020, the industry has shown some resilience as we turn to 2021.

Industry sentiment is strong in the U.S., especially when compared to the month following the onset of the pandemic. This confidence likely stems from a modest rebound in demand and pricing as well as the rollout of multiple COVID vaccines, which should help the U.S. avoid lockdowns in 2021.

|

Fastmarkets, an intelligence service for metals professionals, has upgraded their 2021 steel price forecast due to a relatively strong economic recovery in the U.S., increased vaccine adoption, pent-up demand for all industries, and substantial government assistance. Steel is expected to trade at 5169.23 Yuan/MT by the end of this quarter, according to Trading Economics global macro models and analysts expectations. Looking forward, we estimate it to trade at 4226.71 in 12 months time. |

|

Short Range Outlook (SRO) for 2021 and 2022

On April 15, The World Steel Association (worldsteel) released its Short Range Outlook (SRO) for 2021 and 2022. Worldsteel forecasts that steel demand will grow by 5.8% in 2021 to reach 1,874.0 million tonnes (Mt), after declining by 0.2% in 2020. In 2022 steel demand will see further growth of 2.7% to reach 1,924.6 Mt.

The current forecast assumes that the ongoing second or third waves of infections will stabilise in the second quarter and that steady progress on vaccinations will be made, allowing a gradual return to normality in major steel-using countries.

While it is hoped that the worst of the pandemic is passing, there is still considerable uncertainty for the rest of 2021. The evolution of the virus and progress of vaccinations, withdrawal of supportive fiscal and monetary policies, geopolitics and trade tensions could all affect the recovery envisaged in this forecast.

For the future, structural changes in a post-pandemic world will bring about shifts in steel demand shape. The steel industry will see exciting opportunities from rapid developments through digitisation and automation, infrastructure initiatives, reorganisation of urban centres, and energy transformation. All at the same time as the industry is responding to the need to produce low-carbon steel.”

In ASEAN, disruptions to construction projects hit the fast-growing steel market, and steel demand contracted by 11.9% in 2020. Malaysia and the Philippines were the most severely hit, while Vietnam and Indonesia saw only a modest decline in steel demand. Recovery will be driven by a gradual resumption of construction activities and tourism, which will accelerate in 2022.

At AM Industries Vietnam, we are passionate about metal processing and manufacturing in which we operate. According to customer request we manufacture steel components from small to large steel parts such as punched parts, laser parts, complex components, box dumper, and special designs.

And our company is ready to receive orders to design parts, components according to your needs, ensure the high quality that makes you satisfied with the accuracy of deviations, absolute accuracy, International standards. For further information and a full list of products, please contact us.

Please feel free to get in touch with us for all your inquiries.