China: China seeks to cool red-hot steel sector, and aims at Australia

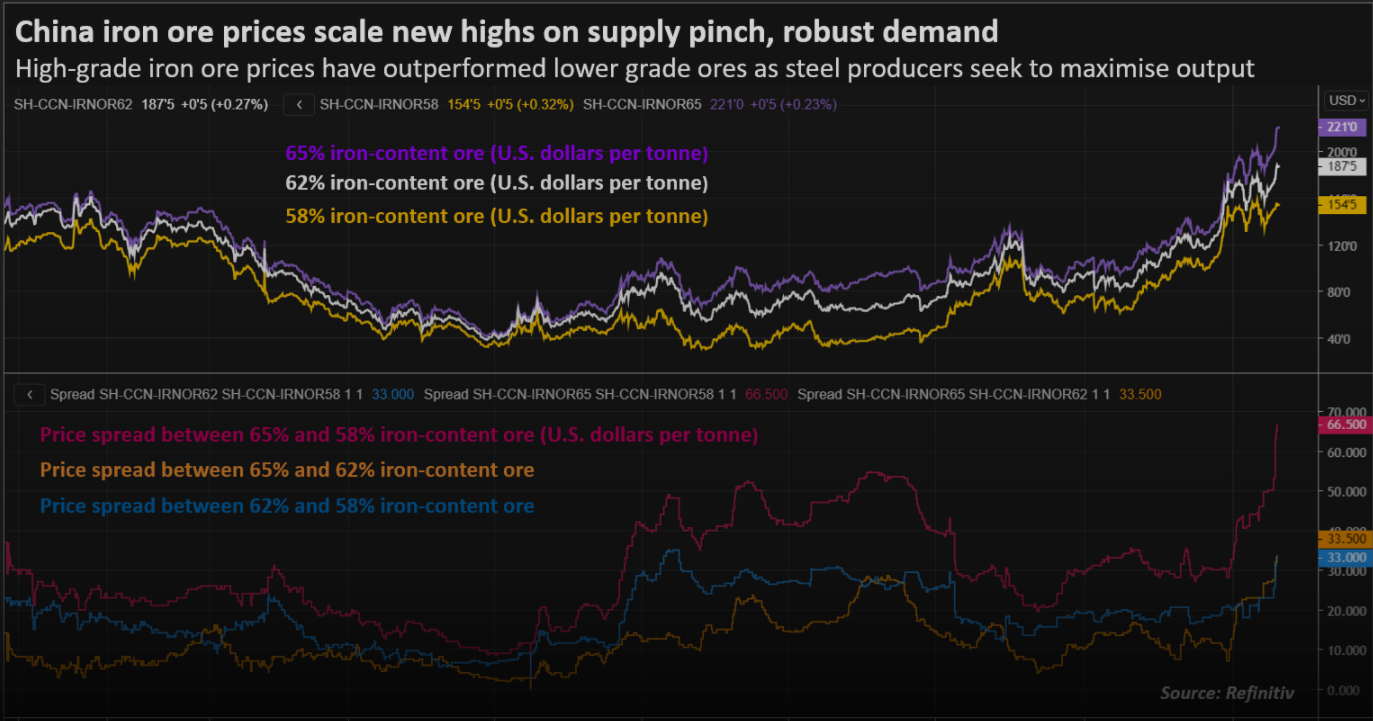

Construction steel – China has moved to cool its red-hot steel sector by discouraging exports and boosting imports of some feedstock alternatives to buoyant iron ore, steps largely viewed as short-term measures to calm prices.

But there are likely some longer-term implications as well, as Beijing looks at ways to reduce the reliance of the world’s biggest steel producer on Australian iron ore. Australia is the world’s largest exporter of the steel-making ingredient and meets about two-thirds of China’s import needs, a situation that is likely uncomfortable for Beijing given the ongoing political and trade tensions with Canberra.

China’s finance ministry announced on April 28 that it will remove export tax rebates for 146 steel products from May 1, while waiving import tariffs for some products, including pig iron, crude steel, recycled steel raw materials and ferrochrome. The end of the export tax rebates may affect about 33.35 million tonnes of steel exports a year, according to Tang Chuanlin, an analyst with CITIC Securities.

This is significant as China exported 53.67 million tonnes of steel products in 2020, and in the first quarter of this year it shipped out 17.68 million, up 23.8% from the same period a year earlier. If the removal of the export rebates renders Chinese steel products uncompetitive in regional markets, it may result in mills reducing output as they will be reluctant to oversupply the domestic market and thus drive down prices and profit margins. At the same time as the authorities moved to restrict exports, they made it cheaper to import some steel feedstocks, which may serve as a substitute for iron ore.

While pig iron and recycled and scrap steel aren’t direct substitutes for iron ore, they can be used to make steel using electric arc furnaces. This means more steel could be produced from feedstock other than iron ore, with the added advantage of being less polluting, given that electric arc furnaces don’t use coking coal as an energy source.

Overall, it appears that the authorities are trying to tackle the problems of high domestic construction steel prices, strong imported iron ore prices, and the level of pollution created by producing steel in one fell swoop.

ALTERNATE SOURCES

Trimming China’s overall steel output by crimping exports, while boosting the supply and price of alternative feedstocks will only have a marginal impact on the quantity of iron ore China needs to import.

A longer-term strategy of securing other sources of iron ore is also underway, with Chinese companies involved in developing the Simandou project in the west African nation of Guinea, often said to be one of the last, and best, undeveloped iron ore projects.

However, while the reserve at Simandou is world class and easy to mine, the logistics of getting the ore to the coast are challenging and therefore expensive to overcome. This cost challenge, coupled with the potential for political instability in Guinea, has seen major miners such as Rio Tinto be cautious about developing Simandou.

However, China seems to be willing to take risks and accept the likelihood that Simandou may never deliver strong returns on its potential $15 billion price tag. That’s a strong signal that cutting dependence on Australian iron ore is a Chinese priority. (Editing by Muralikumar Anantharaman)

Source: www.reuter.com

Australia: BHP launch of South Flank creates world’s largest iron ore hub

BHP has delivered first ore at the South Flank iron ore mine in the Pilbara region of Western Australia after $4.65 billion and 9000 jobs made it possible.

The 80 million tonne per annum (Mtpa) mine is the largest iron ore mine Australia has seen in over 50 years and will combine with BHP’s Mining Area C to become the largest iron ore hub in the world – producing a combined 145Mtpa. BHP’s president for minerals Australia Edgar Basto said the project was delivered on time and budget, allowing for BHP’s Western Australian iron ore (WAIO) mining and processing output to improve as soon as possible.

“South Flank’s high-quality ore will increase WAIO’s average iron ore grade from 61 to 62 per cent, and the overall proportion of lump from 25 to 30-33 per cent,” Basto said.

The project will continue to bring a multitude of benefits to the Australian economy for a number of decades, further strengthening the country’s position as a powerhouse of iron ore mining. With 78 per cent of the $4.6 billion in works awarded to Australian businesses, the project has ensured it gives back to the communities which allowed it to progress. Both the Western Australian Premier Mark McGowan and the Federal Minister for Resources, Water, and Northern Australia Keith Pitt commented on how significant the operation will be for the state and national economy.

“The South Flank project is an example of my government’s commitment to working with industry to take advantage of the international market and business development trends to create Western Australian jobs,” McGowan said.

“This is a major project that is creating thousands of jobs and again shows why the resources sector is so important to our national economy. Establishing Australia’s biggest iron ore project in half a century is a significant vote of confidence in the industry’s future and its long-term benefits to Australia,” Pitt added.

Source: https://www.australianmining.com.au/

Vietnam: Vietnam seeks to stabilize construction steel prices

The government has asked steelmakers to implement several steps to control rising steel prices that are hurting construction contractors.

Deputy Prime Minister Le Minh Khai has asked the Ministry of Industry and Trade to push for increased domestic steel production towards stabilizing prices. Steel production in Q1 reached 7.6 million tons, a year-on-year increase of 34 percent, according to the Vietnam Steel Association (VSA).

Construction steel is manufactured by Vietnamese Steel Manufacturer

He also said the export of steel should be lowered to ensure that local demand is met. Steel exports in Q1 rose 59.5 percent year-on-year to 1.6 million tons, according to the VSA. Meanwhile, VSA has asked its members to prioritize using raw materials for steel production from local producers instead of imported them at high prices so that their operating expenses and selling prices are lowered.

Steel prices in Vietnam have experienced a 40-50 percent surge since the beginning of the year, according to the VSA, forcing construction contractors to suffer losses and turn down contracts. Construction Steel costs account for 10-30 percent of a construction project.

Source: https://e.vnexpress.net/

If you need support in steel fabrication services, we are only a click away. AM Industries Vietnam providing services based on customized design complied with Australian, American or European Standards, reasonable costs and controlled quality