What’s on steel market and steel prices around the world this August? Here’s a list of interesting things that’s coming this month.

Steel capacity utilization ticks back up to 85.0%

U.S. steel capacity utilization picked back up to 85.0% for the week ending August 21, the American Iron and Steel Institute (AISI) reported.

Steel capacity rises

U.S steel capacity utilization has increased up 85% from 84.7% the previous week. Steel output reached 1,877,000 net tons last week, up 0.4% from the previous week.

In the meantime, steel output for the week ending Aug. 21 went up by 27.2% from the same week in 2020, when the capacity utilization rate reached 65.9%.

For the year to date, U.S. steel production was 60,173,000 net tons, at a capacity utilization rate of 80.4%. The year-to-date production total rose by 19.8% compared to 2020, when the rate reached 66.6% for the equivalent period.

Steel prices continue to gain

U.S steel prices have seen an essentially continuous rise over the past year.

An essentially uninterrupted rise of U.S. steel prices have embarked on an essentially uninterrupted rise over the last year.

Although recent month-over-month increase are not reaching the double-digit record we’ve seen over the past year, the prices are still going up.

U.S. hot roll coil closed Monday at $1,883 per short ton which is up 3.98% month over month. At the same time, U.S. cold-rolled coil closed at $2,088 per short ton, or up 4.56%.

Meanwhile, hot dipped galvanized increased by 2.97% to $2,184 per short ton.

Read more about The 2021 steel price forecast.

Source: agmetalminer.com

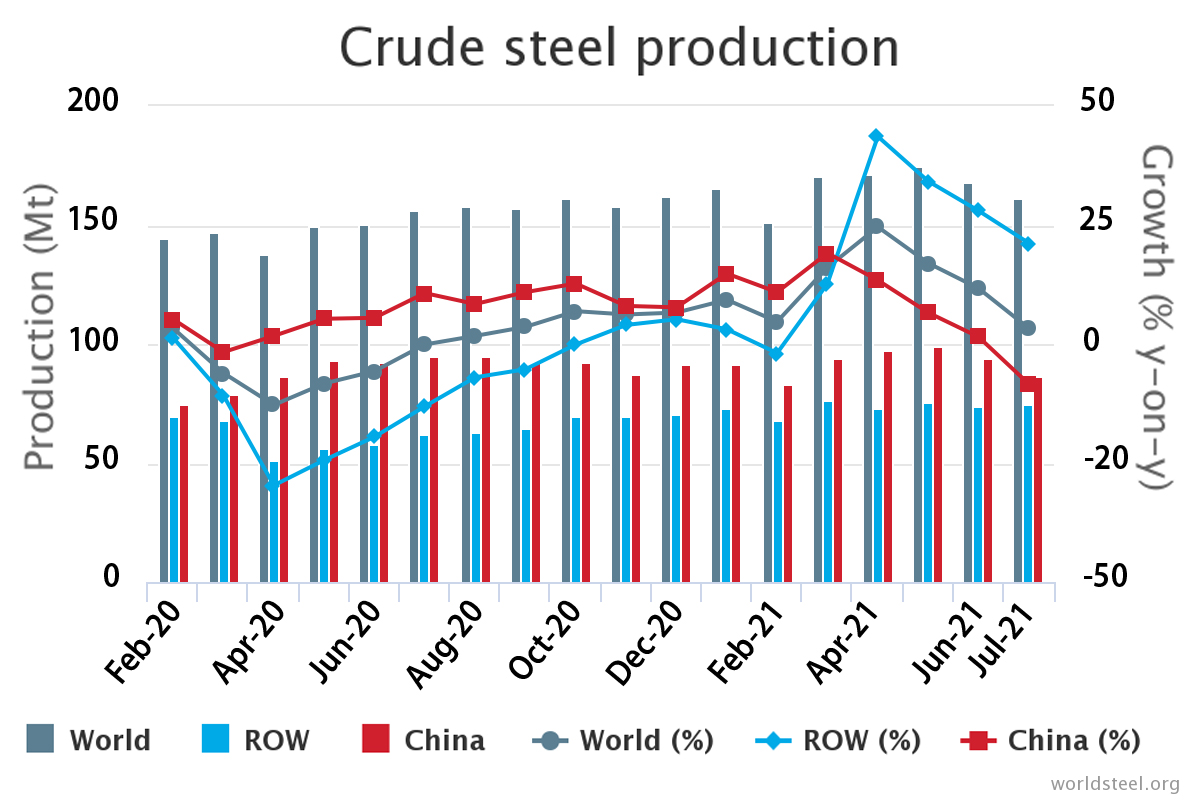

Crude steel production increases in July

The word crude steel production counted in 64 countries in July was 161.7 million tonnes (Mt) or an increase of 3.3% compare to July 2020, the World Steel Association reported.

- Africa produced 1.3 Mt in July 2021, up 36.9% on July 2020.

- Asia and Oceania produced 116.4 Mt, down 2.5%.

- The CIS produced 9.2 Mt, up 11.2%. The EU (27) produced 13.0 Mt, up 30.3%.

- Europe, Other produced 4.1 Mt, up 4.6%.

- The Middle East produced 3.6 Mt, up 9.2%.

- North America produced 10.2 Mt, up 36.0%.

- South America produced 3.8 Mt, up 19.6%.

Top 10 steel-producing countries

- China produced 86.8 Mt in July 2021, down 8.4% on July 2020.

- India produced 9.8 Mt, up 13.3%.

- Japan produced 8.0 Mt, up 32.5%.

- The United States produced 7.5 Mt, up 37.9%.

- Russia is estimated to have produced 6.7 Mt, up 13.4%.

- South Korea produced 6.1 Mt, up 10.8%.

- Germany produced 3.0 Mt, up 24.7%.

- Turkey produced 3.2 Mt, up 2.5%.

- Brazil produced 3.0 Mt, up 14.5%.

- Iran is estimated to have produced 2.6 Mt, up 9.0%.

Source: World Steel Association

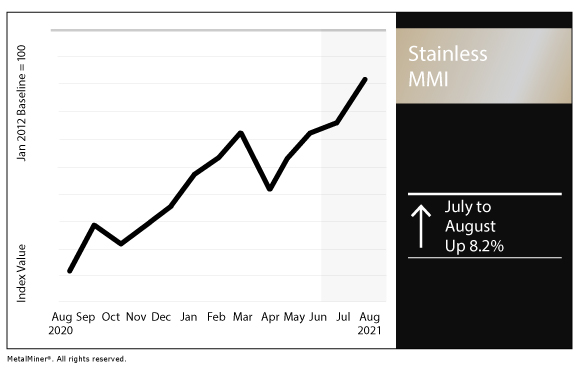

Strong stainless demand to continue on 2022

The Stainless Steel Monthly Metals Index (MMI) rose by 8.2% for this August’s reading.

The stainless steel sales of Outokumpu – Stainless Steel producer went up by 16.8% for the first half of 2021 compared to last year following the company half-year report.

The company stated second-quarter stainless steel demand in the world continues to be robust. They also said total stainless steel deliveries rose by 3% and realized prices in most regions also increased sharply to the previous quarter.

In addition, Reuter reported demand for stainless steel and ferrochrome keep increasing in the near future and delivery volumes falling due to the planned maintenance.

A tight U.S. stainless steel flat-rolled supply through the rest of the year was predicted by Katie Benchina Olsen MetalMiner stainless steel expert. That will continue into at least the second quarter of 2022, she said. Import volumes to the U.S. are also limited while the demand of domestic market remains high. Furthermore, one factors we need to concern that shipping containers supply is tight and freight rates have skyrocketed.

All those factors in domestic environment push stainless steel price higher through at least the first half of 2022.

Actual metals prices and trends

The Allegheny Ludlum 304 stainless surcharge ticked up by 4.9% month over month to $1.07 per pound this month. In the meantime, the Allegheny Ludlum 316 surcharge surged to $1.57 per pound.

Chinese 316 cold rolled coil grew by 13.0% to $4,411 per metric ton as of Aug. 1. Meanwhile, 304 cold-rolled coil surged by 17.2% to $3,359 per metric ton. Chinese primary nickel surged by 6.5% to $22,458 per metric ton.

LME three-month nickel jumped 7.8% to $19,885 per metric ton.

Indian primary nickel increased by 10.2% to $20.05 per kilogram.

Read more about stainless steel components of five major types.

Source: agmetalminer.com

EU steel buyers fear higher prices subject to potential removal of US’ Section 232 tariff

Highlight:

- Removal of tariff could lead to higher EU export prices

- EU push to scrap tariff as mills transition to green steel

- Increased capacity could lessen impact of sec 232 removal

With the summer slow period on its way out, the European market is looking onwards to a possible settlement of the Section 232 steel tariff dispute on November 1, which could restore the flexibility of vital trade routes between Europe and the US, compliant with WTO regulations.

Should the tariff on European steel exports be abolished, domestic buyers fear another surge in local steel prices at a time when hot-rolled coil prices are still above Eur1100/mt ex-works Ruhr, and European domestic stock levels remain exceptionally tight.

The US and EU had previously agreed to work together in resolving a metals trade dispute, following from the former’s Section 232 steel and aluminum tariffs against European exporters by the end of the year, according to a joint statement released following the US-EU Summit June 15.

Reaching a settlement could prove difficult, however, with steel tariffs an integral component of the US steel industry, particularly in heavy-producing states like Ohio, Pennsylvania and Indiana.

There is currently no US steel quota system in place, while steel safeguard measures are firmly entrenched in the domestic European market. From July 1, the European steel safeguards were extended by a further three years and included only a marginal 3% increase to existing quota allowances.

US market perspective on Section 232 mixed

US market sources were also discussing outcomes from a potential resolution of the dispute.

“I am not convinced that there will be an immediate impact if EU is excluded from Section 232,” a US based trader said. “Everyone is talking about Nov. 1 for the date of a potential solution, but I believe there would be a 60- to 90-day transition period.”

The trader added that such decision would pull European prices higher but did not see it as a “game changer” for US pricing due to limited European idled capacity that could be brought back online in the short run.

Some buy-side sources, however, doubted the impact would be limited as they started seeing more European volumes getting booked in the US. Early August, buy-side sources started reporting HRC transactions at around $1,600/st and CRC transactions at around $1,800/st from at least two separate European mills. Prices were on Great Lakes DDP port basis with November arrival times.

Those import deals were still at a significant discount to US sheet prices. Platts US HRC index was at $1,901.75/st and CRC index at $2109.50/st on Aug. 18, both on ex-works Indiana basis.

Source: www.spglobal.com

If you need support in steel fabrication services, we are only a click away. AM Industries Vietnam providing services based on customized design complied with Australian, American or European Standards, reasonable costs and controlled quality.